Do Higher Tax Countries Have it Better?

Does higher tax increase happiness and GDP or is it the other way around?

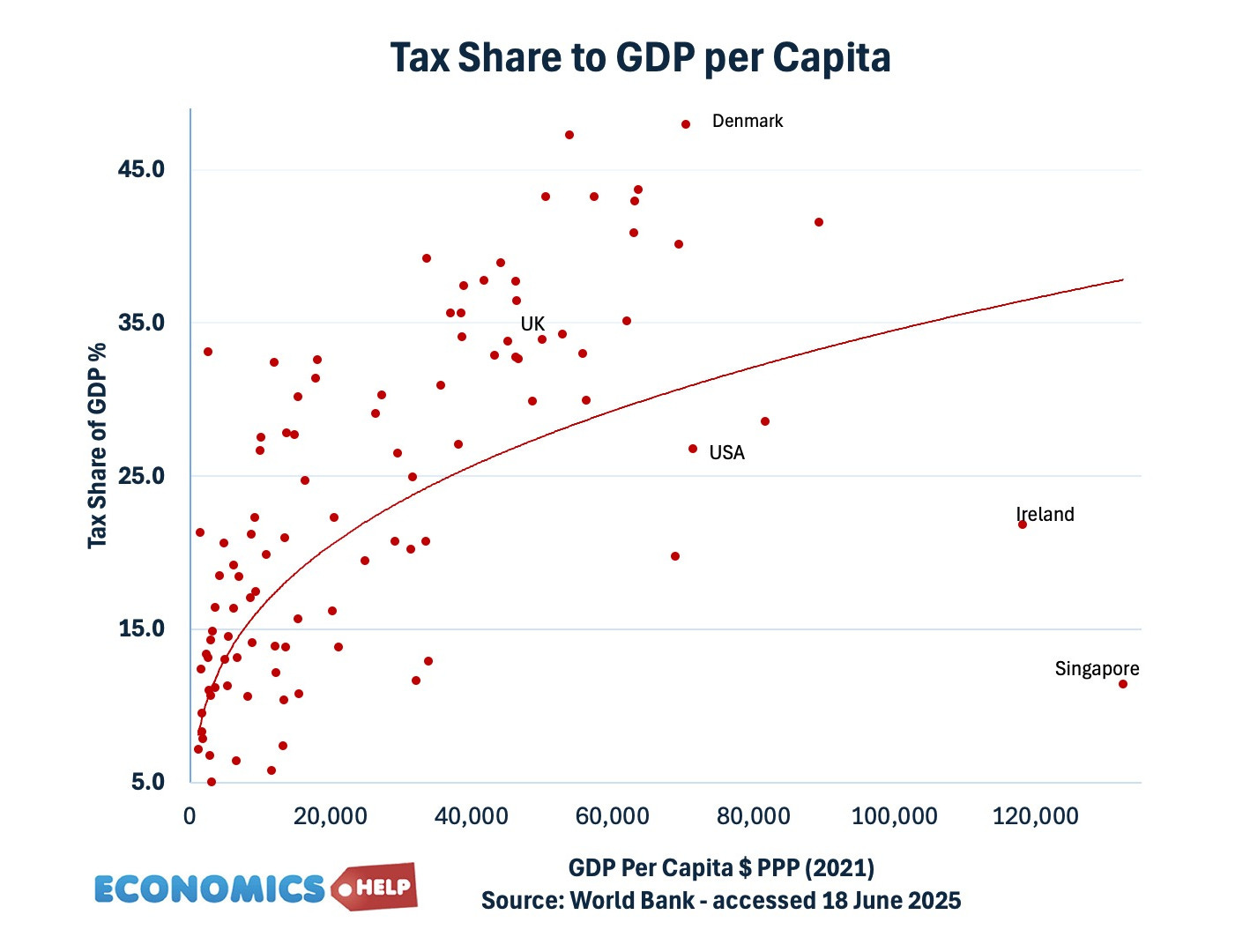

Finland, Denmark and Norway are some of the countries with the highest living standards, quality of life and reported levels of happiness, yet they also have the highest rates of tax in the world. There is a clear trend that countries with higher tax rates tend to have higher rates of GDP per capita. There are some exceptions notably Ireland, United States and Singapore. But, generally speaking countries with higher GDP tend to spend a higher share of national income on education, health, transport and welfare state, all the things that improve living standards in a way the private sector may struggles to do effectively.

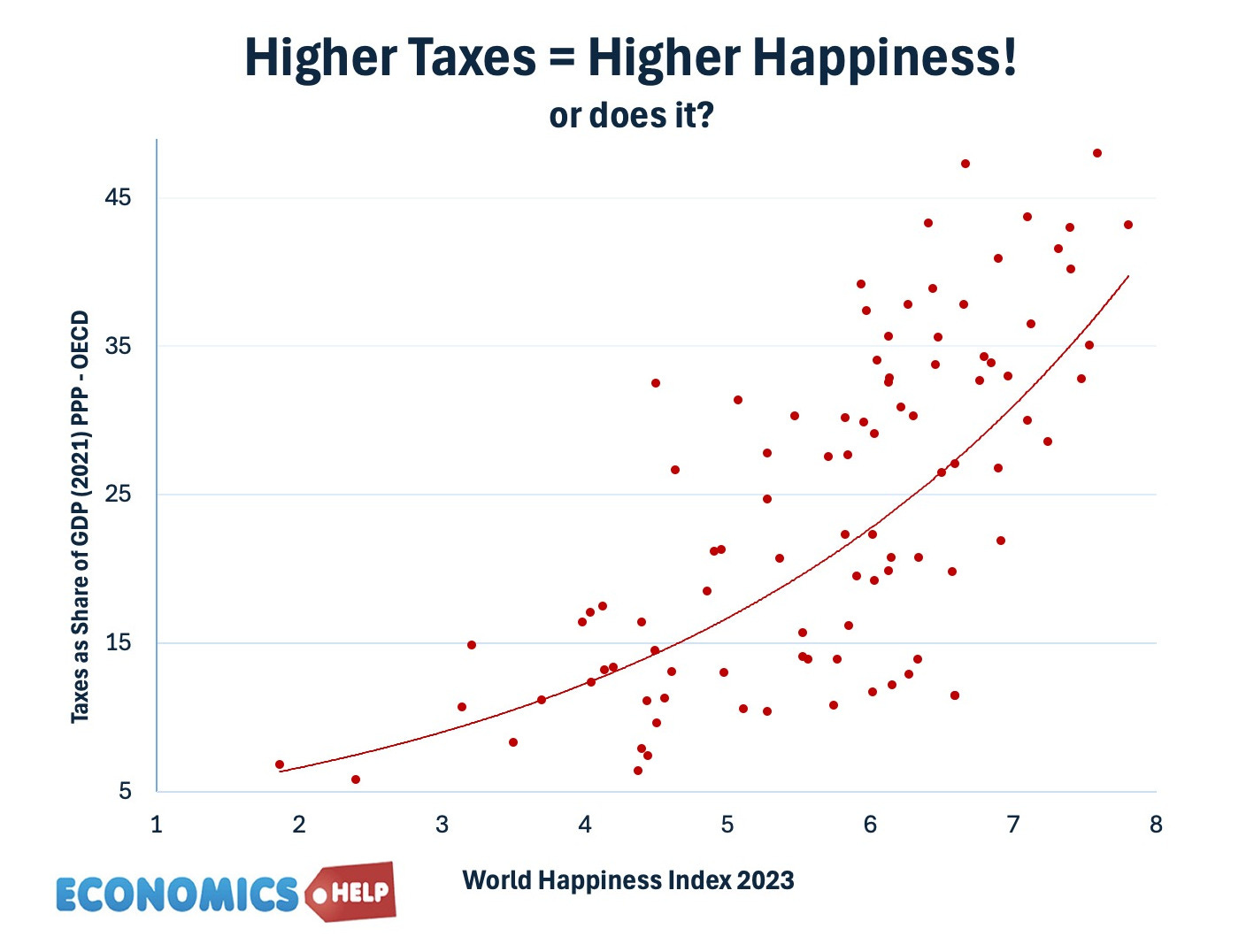

It is similar if we look at levels of reported happiness and tax levels. It is a paradox, people may dislike taxes, yet it is the countries with the highest rates of tax, which generally report the highest levels of happiness.

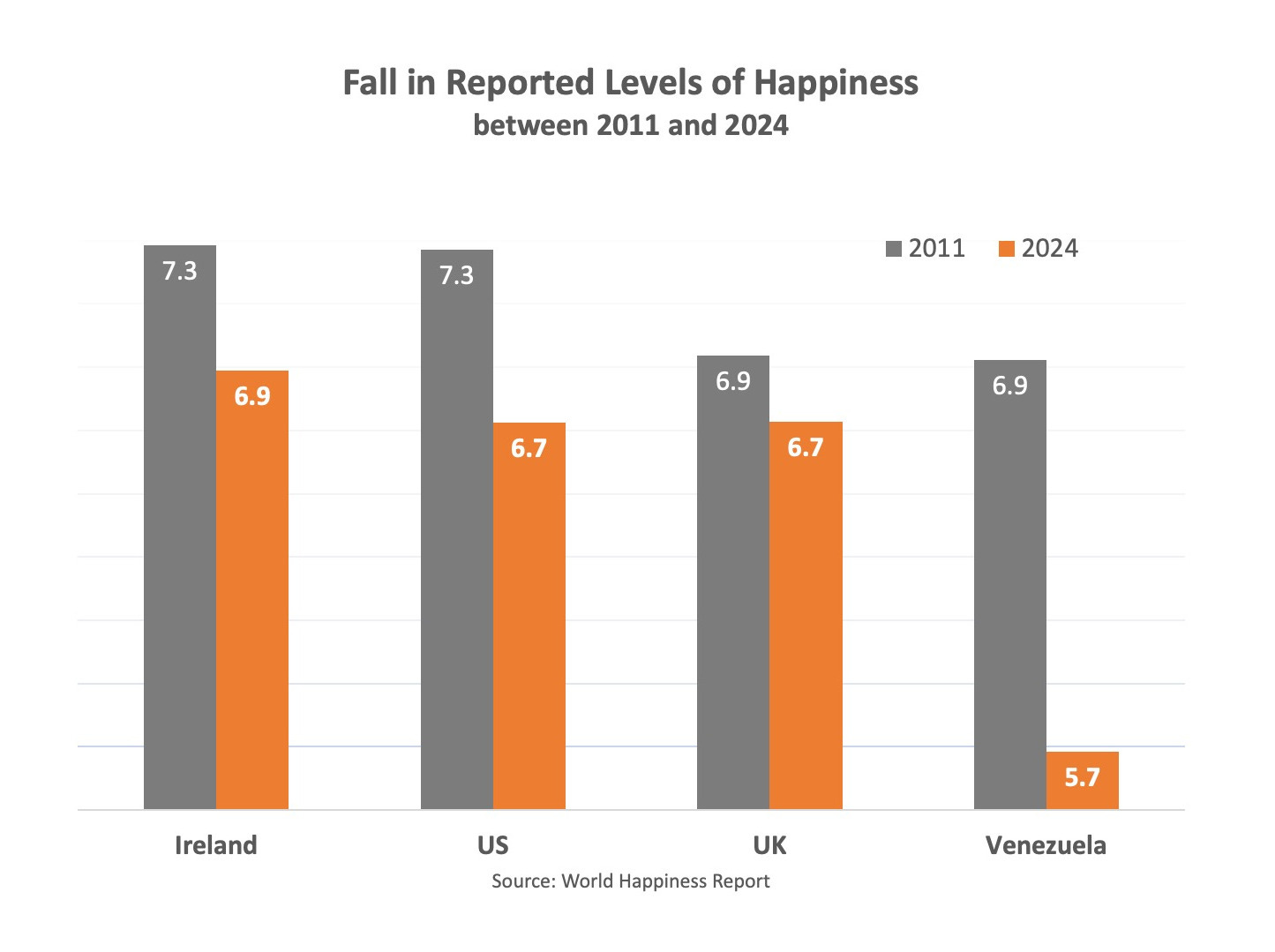

But, is it as simple as this? Since 2011, the world has generally reported slightly higher levels of happiness, but there are countries with declining happiness.

Four examples: Venezuela, US, Ireland and the UK. Venezuela has had an economic crisis, a collapse in GDP, four million people leaving the country, so hardly surprising that there has been big collapse in reported happines. But what about the others? since 2011, GDP in Ireland has more than doubled, tax levels as a share of GNI have remained around 36% and yet reported happiness has fallen. Certainly in terms of economic factors, rising housing costs is a big problem. Rising GDP doesn’t mean much if you struggle to afford somewhere to live.

UK Tax Rates

Now, if higher taxes correlate to more happiness and higher GDP, the UK provides a serious challenge to this thesis. In 1995, the UK tax was only 29% of GDP but today that has risen to 37% and is forecast to keep rising. Yet in this period of rising taxes, there has been no celebration of the fact. Especially in the past 15 years, the UK has experienced stagnant GDP per capita growth and a decline in report levels of happiness.

The truth is there is a big difference between the rising tax share in Scandanavia and the UK. In the case of Denmark, it was a conscious decision in the late 1960s/70s to increase tax rates to fund a more extensive health, education and welfare state. Taxes went up, but voters could also see a visible improvement. You paid more tax, but you got more public services back. And it is the kind of public services that the free market is just not very good at providing. But, in the UK the rise in tax rates is due to a different dynamic. It’s partly a reflection of a stagnant economy. If GDP falls, the tax-to-GDP ratio rises, but that doesn’t mean you’re getting more tax revenue to spend. Also, there was never a conscious decision to let’s embrace a higher tax, improved public services approach. Taxes were always raised reluctantly to deal with the latest fiscal black hole. Any of the extra tax money merely goes on dealing with the rising numbers needing health treatment, pensions and welfare. So although taxes are going up, the increase in tax revenue has been eaten up by an ageing population rather than more comprehensive public services. And then there is the point that when the government do have tax funds to invest, it has a reputation for being very expensive and inefficient. The flagship HS2 was mostly cancelled, but even the leg from London to Birmingham will now cost over £100bn. That is an average cost of £396 million per mile. In China, where, admittedly, local voices are more easily ignored by central government, the average cost is £30m per mile. By the way since 2011, China has had one of the biggest reported increases in happiness levels. At least one country with rising GDP seems to like it.

High Tax, better services?

In another universe, Labout could have campaigned in the 2024 election saying they were going to increase taxes and use this to fund a step change in public services. Invest in cheaper housing, energy and better health care. But, instead, they felt they could only win an election by promising not to increase taxes, a very strong idea in British politics. But, once elected they kind of have to increase taxes anyway which make them very unpopular, but at the same time, it’s not enough tax revenue to make a visible improvement to the key public services. There is the old observation that the UK is heading towards European-style tax rates, but US style public services. In other words the worst of both worlds.

Another difference is that the Scandinavian countries generally increased tax rates, when the economy was growing much faster than it is today. This was smart, because when there is strong economic growth, you can still see rising living standards, even if taxes go up. When the economy is stagnant and taxes go up, you can easily snuff out the economic recovery.

How Increase Taxes

It also depends on how you increase tax rates. These days, there is understandably a lot of interest in taxing the richest 1%. But, if you want to raise 45% of GDP in tax, the tax take needs to be more more broad based. The basic structure of Scandinavian tax system is higher rates of VAT 25%, moderate corporation tax rates and high rates of personal income tax. Only Norway has a wealth tax, just 0.6% on wealth over £1.5 million. Though one of Norway’s successes is a high tax on extensive oil and gas reserves, and then investing that money. VAT is partially progressive, because the rich spend more, but the rich also save more and so for many low-income households VAT ends up being higher share of income. But, at least with VAT it is easy to collect and doesn’t distort incentives to work. However, VAT works in Scandinavia because society is relatively equal to begin with.

US

However, if you took the United States, there is much greater inequality in terms of both wealth and income. And recent tax cuts have favoured the wealthy most. But, cutting tax for millionaires does little to improve overall economic welfare. In recent decades, the United States has seen a big increase in GDP and corporate profitability, but median household incomes have stagnated since the 1980s. So this goes some way to explaining the rising levels of dissatisfaction in the US. It’s not just that the US has low tax rates, but a relatively regressive tax system. It means the high US GDP is somewhat misleading for many, especially those who are bankrupted by the private health care system.

The United States is something of an outlier in terms of high GDP per capita, but relatively low tax rate. The big difference is that the US has a very large private health care sector. Private health care accounts for roughly 10% of US GDP. In other words, US tax rates are lower, but households and businesses pay private health care insurance and costs. It’s just a different way of collecting the money. Yet, there is widespread dissatisfaction with this system. The US is the most expensive health care system in the world, but not necessarily the best outcomes. The US has a notably lower life expectancy than other higher tax, public health care systems. Arguably, replacing private insurance with public health care could help reduce overall costs, improve the quality of health care and provide greater economic security for those who slip through the existing system.

In 1900, life expectancy in Europe was around 45, with high rates of infant mortality. Higher spending on health care, sanitation and education has enabled significantly improved life expectancy, and this is the big boon that countries can enjoy when raising tax rates and government spending. But, beyond a certain point, there can be diminishing returns. Higher tax rates are not guaranteed to increase living standards forever. Once you have a health care system, spending more and more has increased life expectancy only by a small amount. Also, the high tax systems of Europe face a challenge from an ageing population. The French government spends 45% of GDP. One of the highest tax rates in world, and one of the most generous pension systems. But, as more people retire, birth rates fall and the old become a bigger share of the population. It will put more pressure on increasing tax rates to fund pension commitments. But, ever higher tax rates to pay for pensions will have a detrimental effect on the living standards of diminishing young adults, it could also harm economic growth. There is some evidence very high tax rates encouraged wealthy French to slip across the border to Monaco and Belgium. The problem is many economies now face a surge in debt, requiring eventually higher taxes, but these higher tax rates will not lead to the kind of improvements in living standards we saw in the 60s and 70s. The US is a good example of a country facing a debt crisis with spending going up, but politicians are reluctant to increase tax.

Higher GDP = More Tax

Another way to look at this is that as GDP rises, societies generally increase tax as a share of GDP. A developing economy with limited government, doesn’t have capacity to levy taxes on a mostly poor society. But, as incomes rise above the subsistence level, it is more practical to levy taxes, which can be used to fund public services like education and health care.

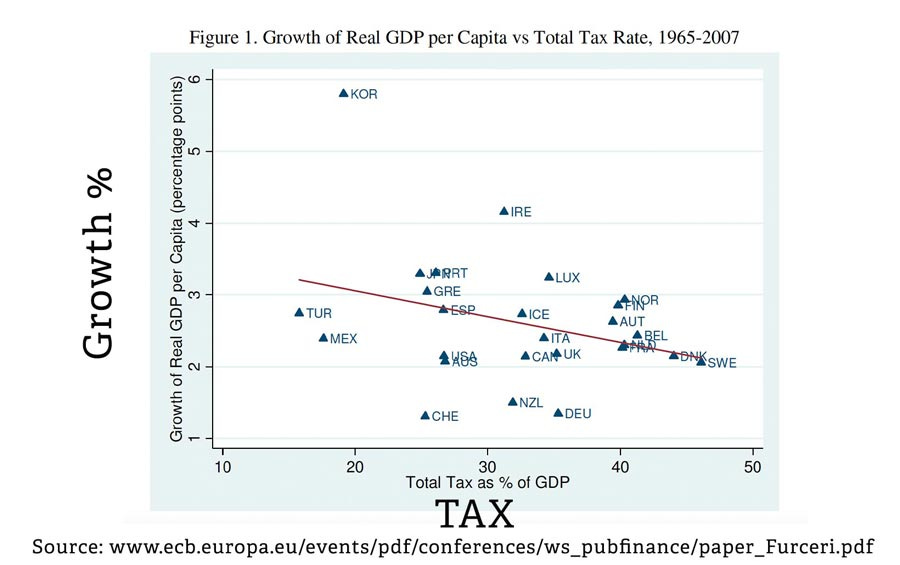

Higher tax rates - lower growth

There is some limited evidence that countries with higher tax rates, can have lower growth rates. Though again, it may not be so much due to high tax, but the stage of economic development. A poor country with low tax rates has ‘catch up’ potential. Growth rates tend to be higher. At higher income levels, growth rates slow down and tax rates go up.

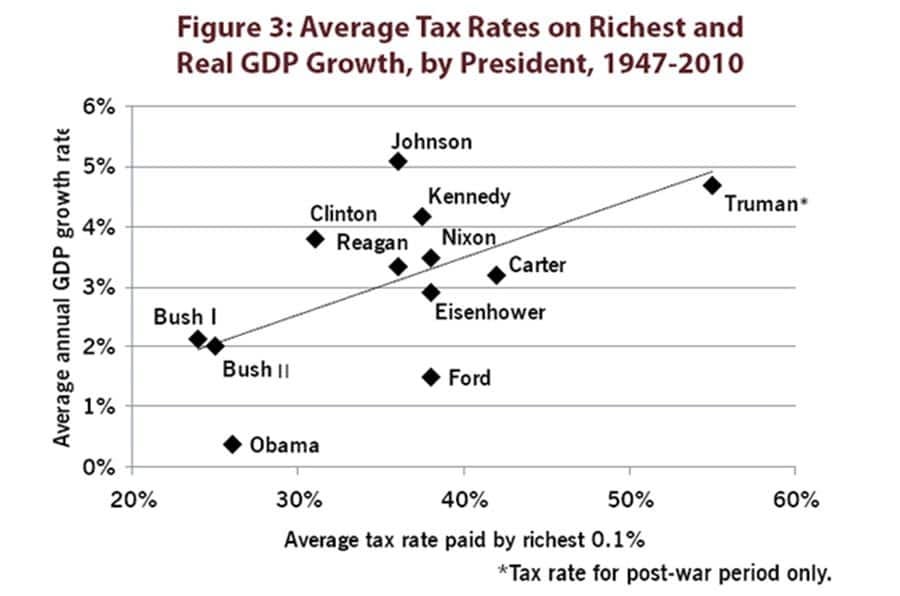

For US presidents the highest rate of growth was under Truman in the post-war period, despite highest tax rates. But, again, I wouldn’t subscribe this to tax rates per-se but all the other factors affecting growth at that time.

US taxes

I went into more detail on this at

Does Higher tax lead to higher growth at economicshelp